Taxation is one of the primary sources of revenue for the Indian government. Without the tax, it will be difficult for them to fulfil the demands of the nation.

Tell me, what comes to your mind every time you hear the word tax?

I know it’s “how do I save my money?” (it goes without saying). But, what else apart from that?

I feel it’s the confusion around Goods and Services Tax (GST).

If you remember, when the GST bill was passed, many businesses (including hotels) in India seemed confused about the tax policies. Some even refrained from doing business.

It’s been quite some time since GST is implemented in India but many hospitality businesses are still not clear about it.

So, let’s dive in and understand some of the important aspects of GST for hotels and how it impacts their business.

Table of Content

What is GST?

GST is a comprehensive single indirect tax reform on the supply and consumption of goods and services.

But do you know why and when did it start? Let’s look at that as well

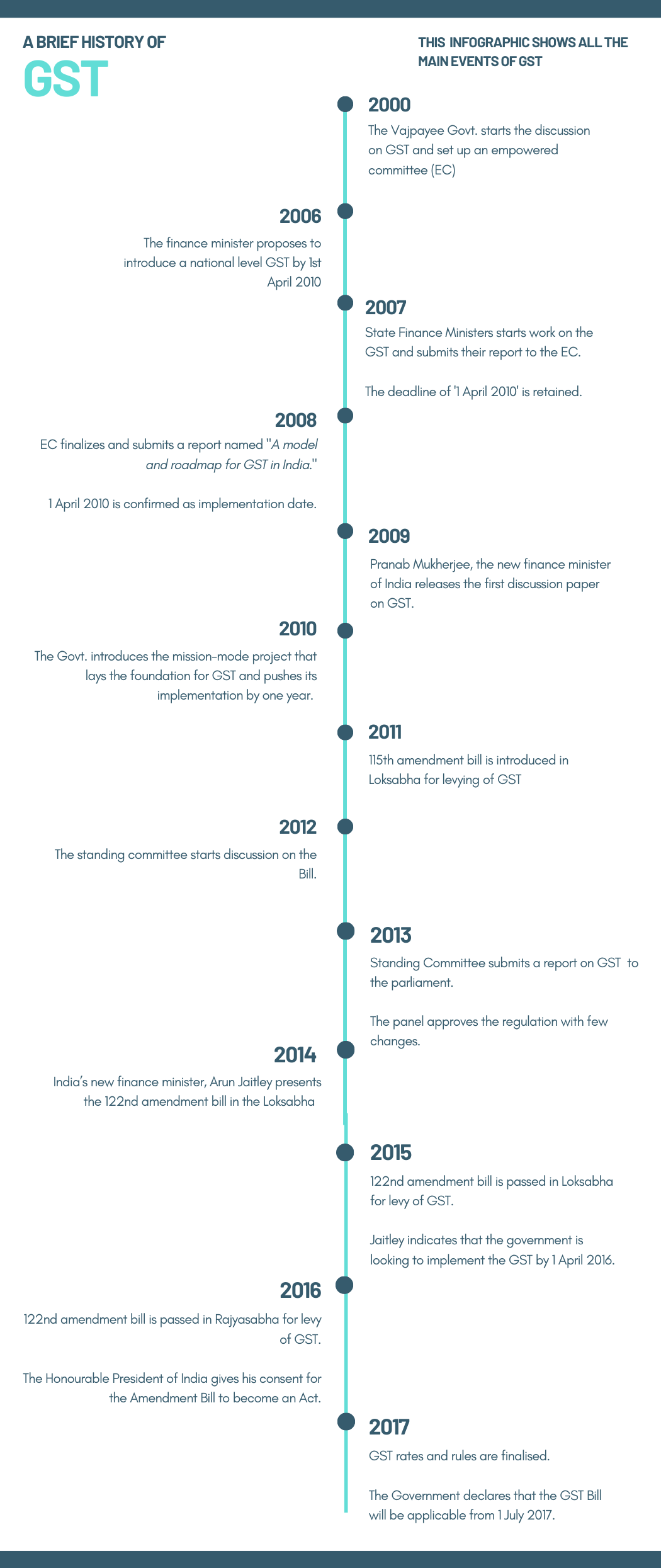

A Brief History of GST

GST was introduced to amalgamate the plethora of indirect taxes into a single tax uniformly applied to all products and services. On top of that, it was expected to make the Indian economy stronger.

Here’s the timeline of GST from 2000 to 2017:

Pros and Cons of GST

Despite all the ‘revolutionary-move talks’, GST has its own set of pros and cons. And you must be aware of them.

Let me help you understand it better.

Pros of GST

- GST streamlined the taxation process bringing all the other taxes under one roof.

- It has now become easier for the common man to understand tax.

- Hotels and restaurants can now compute accurate bills and make the check-out process faster.

- Under the GST regime, it is easier for the tourism and hospitality industry to claim and avail input tax credit (ITC).

- It helps small businesses in filing their taxes through a simple online mechanism.

- GST brings accountability and regulation in unorganised sectors like textiles.

Cons of GST

- The need for businesses to invest in technology has increased.

- The high cost of software purchase to file GST is another reason why it isn’t turning out to be in favour of many businesses.

- According to a source, the GST transaction fees within the financial sector are expensive.

- Under the GST regime, insurance premiums have become expensive.

- Even the price of petrol has increased after GST. And according to a report, petrol price can come down to ₹ 75 if brought under GST

Impact of GST on the Hotel Industry

Just like every other sector, even the hospitality industry was liable to pay multiple taxes and handling them was a tedious task.

Before the inception of GST, a hotel with a room tariff of more than ₹1,000 was liable for 15% Service tax. Further, after the abatement, the value was brought to somewhere around 8-10%. That’s not all. After that, VAT along with luxury tax was applied to the price.

Talking about the restaurants, there was a 60% abatement. Meaning, the service tax was charged at an effective rate of 6% on the F&B bills. And this is apart from the VAT.

But under the regime of GST in hospitality industry, things have become straightforward and services that were earlier taxed separately are now taxed as a bundle.

Not to mention, it has reduced the end-user costs. Meaning, the industry is now likely to attract more overseas tourists, improve the government’s revenues, and boost the industry’s growth.

Talking about the hotel GST rate, it is levied based on the tariff. Here are the updated GST slab for hotels:

How Can Hoteliers Handle GST?

Even though GST has streamlined the taxation process, it is difficult to handle because there are certain GST rules for hotels.

Here is a video that explains everything about how to efficiently handle GST for hotels.

How Can Technology Help?

If you scroll up and read, I have mentioned that businesses are now required to invest significantly in their technology stack. And this might seem like a tough task for many businesses.

However, I would like to shed light on the brighter side as well and talk about the advantages of technology in handling gst on hotels.

Every year, we witness at least some sort of reform in the GST structure to make it more feasible for business and the common man. And something that has become unquestionable is that managing GST compliance is very much dependent on technology.

Everything, from registration, generating and uploading invoices, raising of e-waybill, mismatching reconciliation, to the filing of the refund claim, is done online.

Therefore, it is extremely important that irrespective of the industry, businesses must turn to technology if they want to handle GST and returns seamlessly.

Further, when I am saying technology it’s not just about a hotel gst software; rather, a complete stack. So, if you’re wondering what’s the basic technological infrastructure you need. Here’s an example for a small business. This is what you need:

- Computer

- Internet connection

- A system to record invoice (e.g: Google Sheet, MS Excel)

- Learn to directly upload invoices on the government portal

But What About Hotels?

Hoteliering involves a lot of segments and operations. Meaning, hotels need a system to automate operations, handle GST and reduce discrepancies.

This is where a hotel property management system (PMS) comes into the picture. A PMS provides hoteliers with multiple features to manage their hotel’s operations seamlessly.

However, when you’re deciding on a PMS, you have to be sure that it is compliant with GST.

eZee Absolute, a cloud-based hotel PMS, is one such system that helps you not only automate operations but also make GST-handling effortless.

Here are the advantages of GST-complaint Hotel PMS:

- Calculate GST payable accurately

- Create tax structure easily

- Generate multiple returns to be filed with GSTN

- Integrate with GST Suvidha Providers (GSP) for report submission

- Reduce manual errors in automatic tax calculation

- Get the facility of e-Payment as per applicable GST rates

- Get precise reports for ITC and GST amounts

- Generate GST-compliant invoices and receipts

On account of all the GST norms, eZee Absolute will let you transform your hotel into a GST-ready business, regardless of your segment.

We have a resource to help you get the right hotel software. Do check it out.

Conclusion

GST for hotels is a sensitive segment. It is important that hotels handle it with care; you must know what services or expenses are tax-deductible and what isn’t. Many small to mid-sized hotels fail to do so, which results in taking a serious toll on their finances.

Moreover, you must invest in systems that help you with the process of taxation. A strong accounting team with a tech stack is the key.